Consumer spending took a nose dive in January, declining by almost 6 percent (on an annualized basis), according to the latest data released today by the Bureau of Economic Analysis.

On the heels of recent labor market shake-ups, does the consumer spending data for January portend recessionary tidings? Let’s assess.

Recent changes in consumer spending

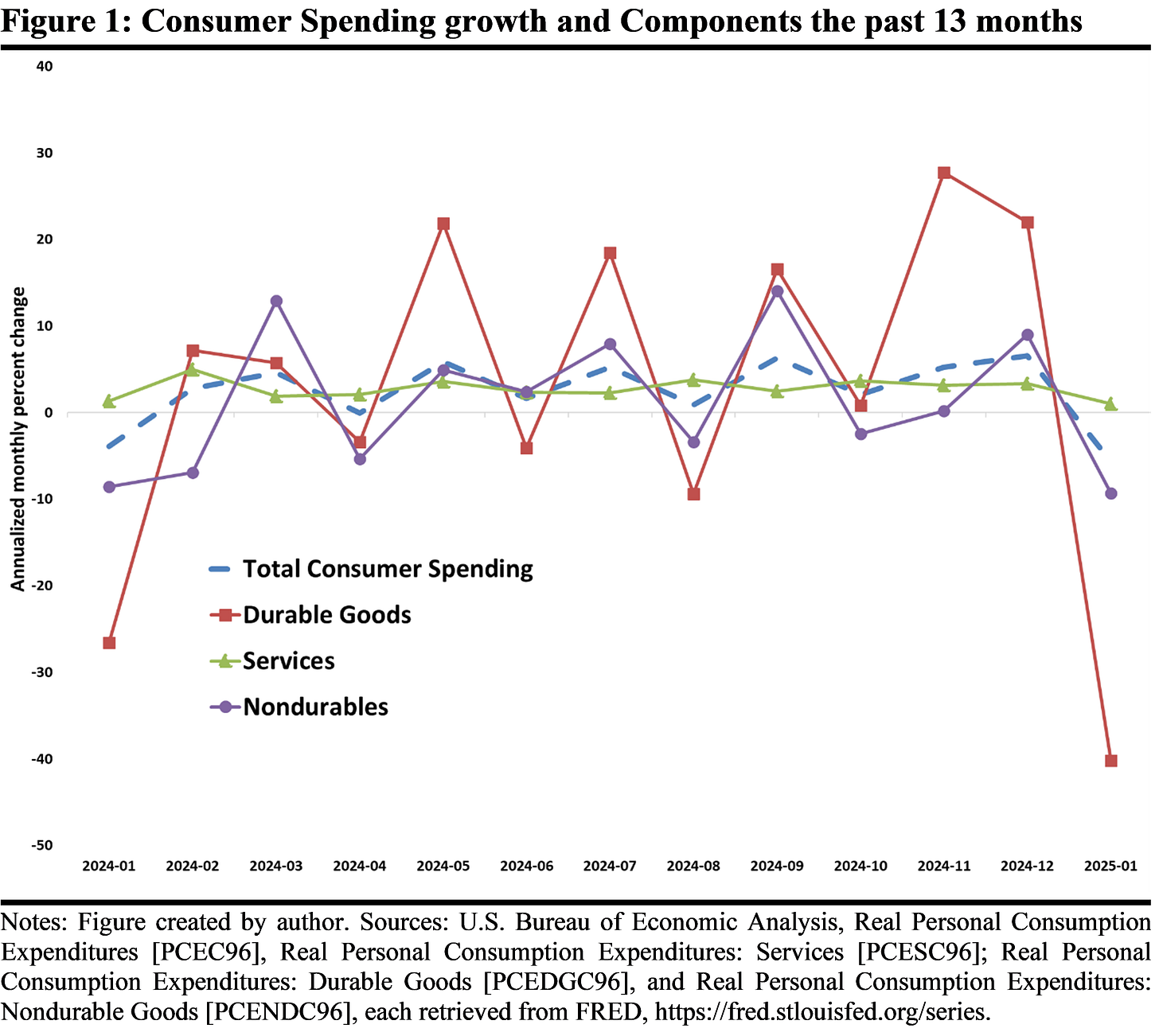

Figure 1 displays the monthly growth rates of consumption expenditure and its components over the past 13 months (percentages shown are annualized).

Total consumer spending—the dashed blue line—averaged about 3 percent per month in 2024. Consumer spending growth was negative twice in the past 13 months (before this past month), last January (about -4%) and in April (only about -0.1%).

So, it is not that abnormal for consumer spending to decline. Since 2021, for example, a period of 49 months, total spending declined in 12 of those months. In those 12 months, too, the average decline was about 3.5 percent. On the other hand, in only two of those months was the drop larger than 4 percent, as it was last month.

Figure 1 also displays the sub-categories of consumer spending, durable goods (red line), nondurable goods (purple line), and services (green line). Spending on durables and nondurables declined. Spending on consumer durables fell by about 40 percent on an annualized basis.

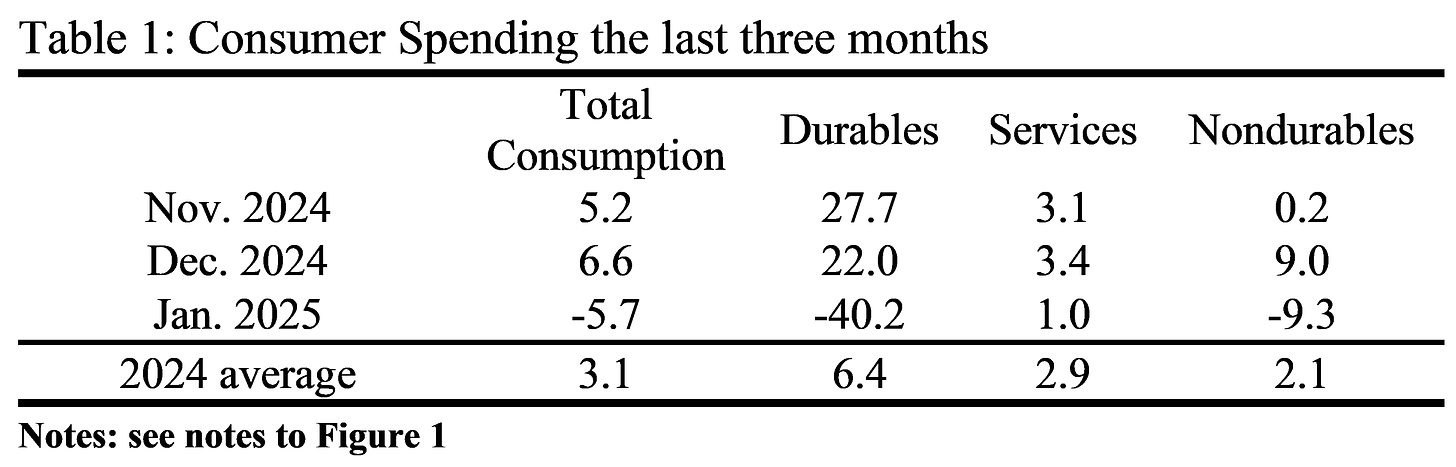

Table 1 highlights the changes in these categories (and total consumer spending) the past three months, compared to the average percentage change over 2024.

Clearly, the values for each category in January arewell off the mark from recent experience. And while it is not abnormal for durables to fluctuate—as evident in Figure 1—the decline this past month is quite large.1

In the case of nondurables, too, there has been a quick reversal (from +9 percent in December to -9 percent). And while services showed positive growth in January, that +1 percent was well below the 2024 average.

A Harbinger?

Is the decline in consumer spending a bad omen for the remainder of 2025? Quite possibly. A change in spending on durables, in particular, may embody the mood of consumers. Are you worried about the future? Well, best cut back on those bigger expenditures then. So, perhaps such a mood is behind the January numbers.

Yet, it is always very easy to overreact to current events and/or current changes in economic data. Consumer spending fell by about 4 percent last January; however, that change did not start a month-after-month decline. Instead, consumer spending averaged about 3 percent per month in 2024. That was right in line with historical experience—consumer spending averaged about 2.9 percent the past ten years (from January 2015 to December 2024).

Durables over that time period average 6.6 percent growth, which makes the 40 percent drop last month pretty alarming. But, the standard deviation for monthly spending on durables was about 46 percent over the past ten years. In other words, we should expect a 40 percent drop in durables like just happened last month about two-thirds of the time.2 That means last month is not an outlier. That is not to say it is not a concerning data point, just that it is not that unusual.

Durables declined in 22 of the last 49 months (since January 2021); of those 22 months the average decline was about 19 percent. Of those declines, in only three instances did the decline exceed 40 percent.

Assuming a normal distribution, 67 percent of all outcomes will be within one-standard deviation of the average.