The Fed has made news this fall with two successive interest rate cuts. On the heels of the last cut, Fed chairman, Jerome Powell, was asked about his chances of staying employed in that role in the second Trump administration. His answer was straightforward and short, somewhat reminiscent of former football star, Marshawn Lynch’s famous press-conference response of “I’m just here so I don’t get fined.” Powell’s answer was more along the lines of “I’m here to talk about the economy” (you can watch the press conference here, or read the transcript here).

And while some news outlets claimed (with sensationalistic headlines) that Powell said things like “he couldn’t fire me if he wanted to”—that is not even remotely close to Powell’s actual responses—the question to Powell probably caused many to wonder, “who the h**l is Jerome Powell, anyway?”1

The Fed’s Structure

The Federal Reserve was created with the Federal Reserve Act of 1914. The Act specified the following structure of the Fed: One Board of Governors in Washington D.C. “The Board,” 12 Regional Banks (in 12 designated regions of the United States); plus one “Federal Open Market Committee” (FOMC)—the latter of which is made up of all seven “Governors” of the Board of Governors, and five of 12 “Presidents” that head each of the 12 regional banks.

While there is a lot of history motivating the creation of the Fed, and a lot of details related to the general structure just described, for this post, let’s focus on the top seat, the Chair of the Board.

The Federal Reserve Board is comprised of seven governors, appointed by the President of the United States (and confirmed by the Senate). Each governor serves a 14-year term. Of the seven, one person is chosen (by the President of the United States) to serve as the Chairman of the Board, which also means they are the head of the Federal Reserve system, and chair of the FOMC. They are the boss, in other words. The term for the Chair position is four years. If the person is not renewed as the Chair (at the end of their four-year term), they can still serve out whatever years they have left on their overall 14-year term.

Note that once a person is appointed as a Governor, they have the legal right to serve out their 14-year term; and the Chair has the legal right to serve out their 4-year term (the “right” comes from the Federal Reserve Act). Said person cannot be removed as a governor by the President or anyone else unless for “cause,” which means they commit some heinous act related to a crime or some serious dereliction of duty.

“Cause” does not include a member of Congress or the executive branch disagreeing with a Governor’s decision—say, to raise or lower interest rates. The 14-year term and the protections from reprisal over those 14 years are features specifically intended to insulate the Board of Governors from political pressure (the 14-year term also ensures each Governor will overlap multiple presidents).

One controversial aspect of the Board of Governors is they are not elected officials. As noted above, they are political appointments. Given the power afforded to the Federal Reserve officials (afforded by Congress, by the way, as explained here by Macrosight), one might wonder how does one end up as a Governor? And, like Jerome Powell, how does one end up as the Chairman of the Board?

Making it to the Major Leagues

The short answer is that you have to have had a career related to finance, economics and politics—preferably some mixture of all three. That is, you had to have been successful enough in your finance or economics career to make your way to Washington D.C. and serve in some sort of political role. That role or roles got you noticed by the various power brokers in D.C. if not by the Federal Reserve itself (or one of your political-related jobs was at the Federal Reserve).

Take Jerome Powell, for example. His background is in investment banking for the most part, though he started his professional life as a lawyer. Then, amidst his career in the financial world, he held a position in the Treasury Department from 1990 to 1992 under the George H.W. Bush administration. Much later from 2010 to 2012 he hung out in Washington D.C. at a think tank focusing on economic policy. While there he garnered the attention of officials in the Obama administration. Even though Powell was politically-affiliated as a republican, President Obama appointed him as a Governor in 2012. In 2018, President Trump elevated Powell to the position of Chairman.

Considering there are only seven members of the Board of Governors, and each term lasts 14 years, it is a relatively small group of people that have ever served as a Governor of the Fed. It’s an even rarer group that has made it to the top spot (Powell is the 16th person to ever do it).

I like to joke with my macro classes that while no kid ever lies awake at night dreaming of making it to the Board of Governors—like they might do so imagining hitting a home run in game 7 of the World Series, or winning the Super Bowl—it is still a pretty big deal to make it all the way to the Board. Continuing with the joke, I tell them I collect Fed Board members trading cards, like others collect baseball or Pokémon cards.

While no such set of trading cards exist (alas), Macrosight imagines the front and back of Jerome Powell’s trading card would like something like this:

Perhaps it wasn’t Powell’s life-long goal to become Fed Chairman, but it is certainly possible that the idea might have entered the minds of two of his predecessors in the position, Janet Yellen and Ben Bernanke. Both Yellen and Bernanke started their careers as academic macroeconomists.

The Professors

Janet Yellen served as chair of the Federal Reserve Board from 2014 to 2018 (she is the only woman to serve in that role). Prior to that she was “vice-chair” of the Board, and prior to that—from 2004 to 2010—she served as the President of the Federal Reserve Bank of San Francisco (one of the 12 regional banks mentioned earlier). Currently, she is the Secretary of the United States Treasury. You can see some of those details here in her trading card:

Before her government service, however, Janet Yellen was known as “Professor Yellen.” After earning her PhD in economics in 1971, Janet Yellen served as a professor macroeconomics at Harvard, the London School of Economics, and for most of her career, at the University of California, Berkeley. Along the way, she became one of the most accomplished macroeconomic researchers of all-time publishing numerous academic studies. In many respects, Janet Yellen’s career was tailor-made for her to end up serving as the Chair of the Federal Reserve, a career which serves as an inspiration to macroeconomists everywhere.

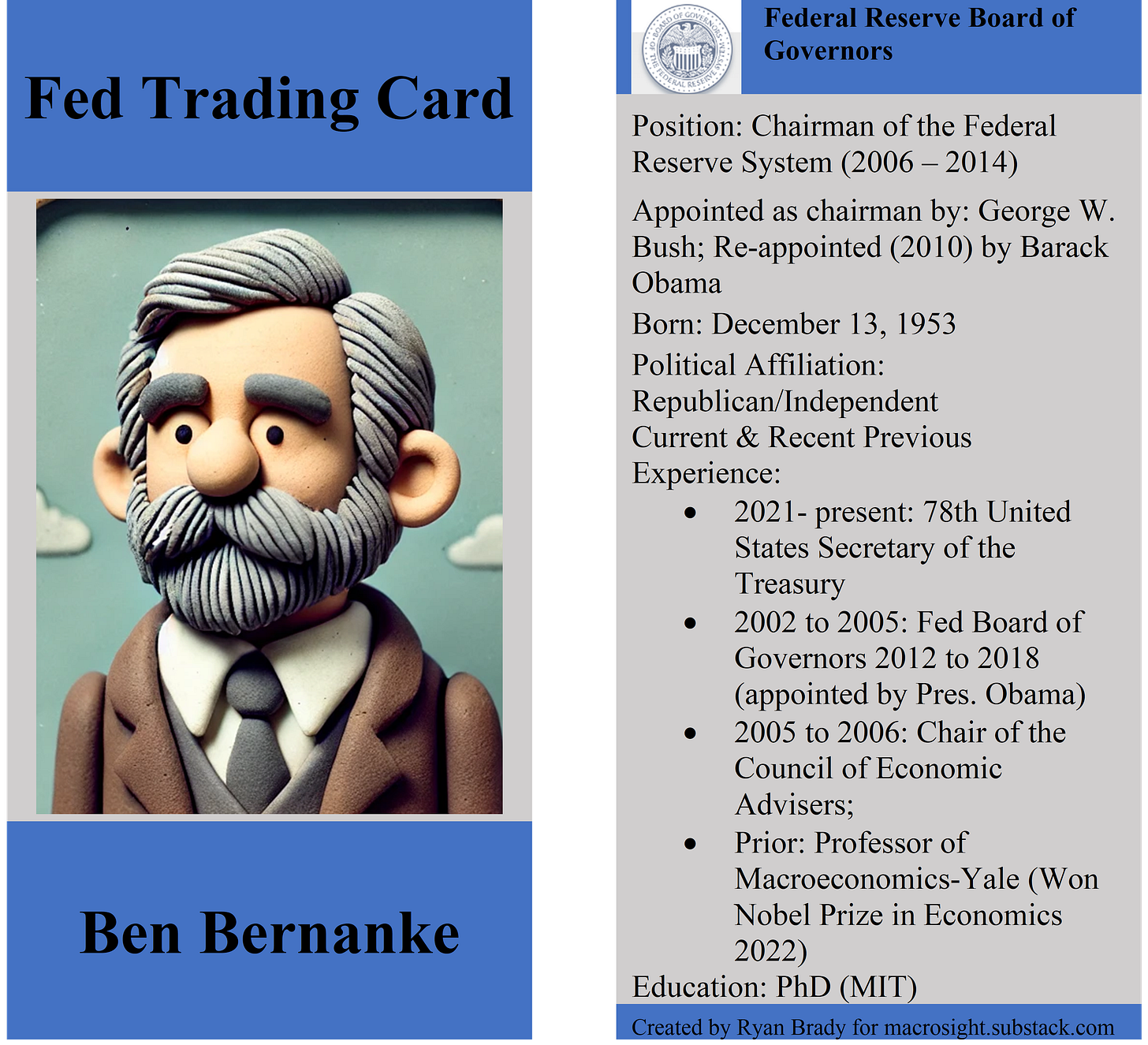

Janet Yellen’s predecessor, Ben Bernanke, served as the Chair from 2006 to 2014. He was yet another macroeconomics professor that made it all the to the Big Leagues.

Ben Bernanke’s career follows a very similar trajectory to Janet Yellen’s. Like Yellen, he was a long-time professor of macroeconomics. Then, also like Yellen, he worked his way through policy positions at the Council of Economic Advisors then at the Fed. Like Yellen, too, he was an extremely accomplished macroeconomic researcher. In fact, Bernanke won the Nobel Prize in Economics in 2022 for his work related to how the banking system and financial crises affect the macroeconomy. One of his most famous papers was on how the banking crisis of the early-1930s exacerbated the economic collapse of 1929 to 1933.

In a remarkable historical coincidence, Ben Bernanke was at the helm of the Federal Reserve when a once-in-a-generation (or even more generations) financial crisis occurred, in 2008. I say coincidence because what are the chances that the head of the Federal Reserve, during such a time, also happened to be the foremost expert in the world on the effects of a financial crisis on the macroeconomy? Seriously, what are the chances of that?!2

The Godfather

Perhaps the most famous Federal Reserve chairman of all time, Alan Greenspan served as the Fed Chair from 1987 to 2006.3 Referred to as The Maestro by Bob Woodard, Greenspan had a heck of a run, characterized by his Just Do It approach to monetary policy, and one that outlasted the typical 14-year term.4 He was appointed by Ronald Reagan, re-appointed by George H.W. Bush, reappointed twice by Bill Clinton, and then reappointed a last time by George W. Bush.

Greenspan’s reputation was burnished from serving as Fed chair over the 1990s boom, where real GDP growth averaged 3.8 percent from the end of 1991 through the end of 2000. The boom was also accompanied by the stabilization of inflation, which averaged 2.6 percent over the same time period (as measured by the CPI for all items). Within that decade, too—around 1994 to 1995—the Fed achieved the rare “soft-landing,” which set up the economy and the stock market for its bullish run over the second-half of that decade.5

While Greenspan did draw criticism in the aftermath of the 2008 financial crisis, with some blaming him for allowing the housing market to turn into a bubble and bust, ultimately the disinflation that occurred over the 1990s, amidst a booming economy and stock market, is his lasting legacy.

A Distinguished Group

Greenspan, Bernanke, Yellen and Powell account for just four of 16 persons that have served as head of the Federal Reserve. What is important about all of them is that they headed the Fed with independence. That meant they could tackle their dual mandate given their best judgement and the collective judgement of the other members of the Federal Reserve. And they could do so regardless of whether the president, or the party leaders in the House or Senate, agreed or disagreed with their decisions. The Fed Governors and particularly the Chair, are afforded that independence given their expertise and experience.

As the four trading cards displayed above reveal, that experience is extensive. Their collective knowledge, too, of financial markets and the macroeconomy represents a vast reservoir of understanding and acumen. They don’t always get it right (as noted here and here by Macrosight), but the fact the U.S. economy continues to be the most dynamic and robust economy in the world is a testament to them getting it right more often than not.

There have been other notable holders of the position of course, and there have been many more that served with distinction as governors (but never served as Chair). I am still collecting those trading cards; however, otherwise we could have highlighted a few more along with Greenspan, Bernanke, Yellen and Powell. I’m still searching for Paul Volcker’s card, for example. Volcker, Fed chairman from 1979 to 1987, is known as the Great Inflation Slayer, and he helped pave the way for Greenspan’s success. I keep looking for his card on eBay, but as of yet, I’ve had no luck.

The title of this post, while grammatically incorrect, is inspired by the children’s “Who Was . . .?” series, a series my kids read when they were younger and I recommend to any parent with young kids.

Much of Bernanke’s research—prior to him joining the Fed—related to the possible tools the Fed could use during a crisis. Take this paper from 2004, for example. And he actually had the chance to put his “money where his mouth was”!

While there have been many distinguished Fed chairman (for example, the Board of Governors building in Washington D.C. is named after Marriner S. Eccles, chairman from 1934 to 1948), I say Greenspan is the most famous because his reign coincided not only with the prosperous 1990s, but also with the growth of round-the-clock cable news coverage, which became a “thing” in the very-early 1990s. That round-the-clock coverage made Greenspan something of a media star, which was certainly a first for any Fed official.

I prefer “The Godfather” over the Maestro for Greenspan’s nickname. I see him less of a conductor and more like Brando’s Vito Corleone, using his wiles and influence to land Jonny Fontaine a movie role (convince Bill Clinton to reign in deficit spending), sniff out Barzini’s plotting (pulling off a soft-landing in 1995), and guiding his son Michael to the end game that was to come (the economic boom of the late 1990s).

Macroeconomist and former Fed Governor, Alan Blinder, describes this “soft landing” here. Blinder also has a detailed history of the Fed, “A Monetary and Fiscal History of the United States, 1961-2021.”