It has been a bit since Macrosight checked in on the big consumer spending categories. While the growth of consumer spending has been positive in 2024, recent jobs-related news has many feeling twitchy. I also read somewhere recently that pessimism related to the macroeconomy—in spite of stable economic data—may partly be due to the fact that many still have in their heads memories of 2021, when consumers, flush with stimulus, were spending like crazy. Compared to then, today is leaving many wanting.

Let’s see what the data says.

The 2024 Blues?

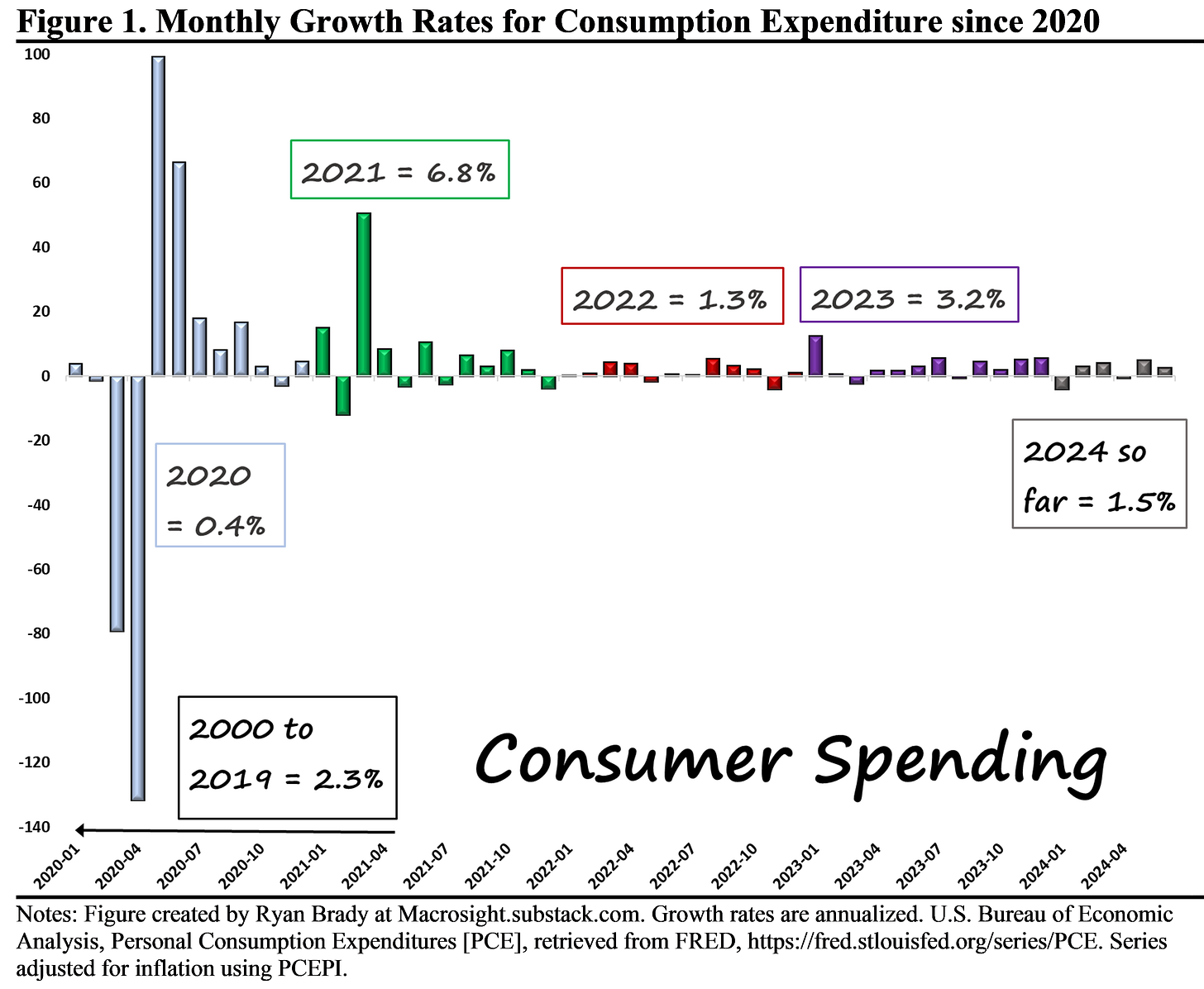

Figure 1 displays the monthly growth rates of total consumption spending for the U.S. economy, from 2020 through June of this year.1 The bars of the figure are color-coded to identify each year, with annotations highlighting the average growth rate for each (and the historical average from 2000 to 2019).

As annotated on the graph, so far in 2024 consumer spending is averaging 1.5 percent per month. Not terrible, but not great either. We are well below the average from last year, and clearly not even close to the high rate from 2021 (and the second of half of 2020, for that matter). In 2024 we are also below the 2000 – 2019 average of 2.5 percent.

With respect to the sub-categories of consumption—durables, nondurables and services—we see a similar pattern. Table 1 displays the numbers for each.

Except for services, spending is clearly lower in 2024 than 2023 or relative to the historical averages.

Hence, while consumption spending has been “hanging in there,” our rates of spending are below where they have been recently.

A Portent?

Does the Hungry Breast’s apparent lack of vigor portend macroeconomic ills? It is certainly possible, of course. We had a similar year in 2022 (as these first six months of 2024), yet said Beast rebounded in 2023. That is, our anemic first half, need not imply a lethargic second half. In fact, consumer spending averaged 3.7 percent over May and June; if that signals an upward trend the last half of 2024 may be a very different story than the first half. That might especially be the case if the Fed decides to cut rates next month. That may certainly give the Hungry Beast a jolt.

The Bureau of Economic Analysis will release consumer data for July next week.