The Fed meets next week, and the chances are high—about 95 percent—that the FOMC will cut its target interest rate. About four weeks ago that probability was around 75 percent. The jump in likelihood comes on the heels of the evidence that the jobs market continues to slow (as reported last week by the BLS).

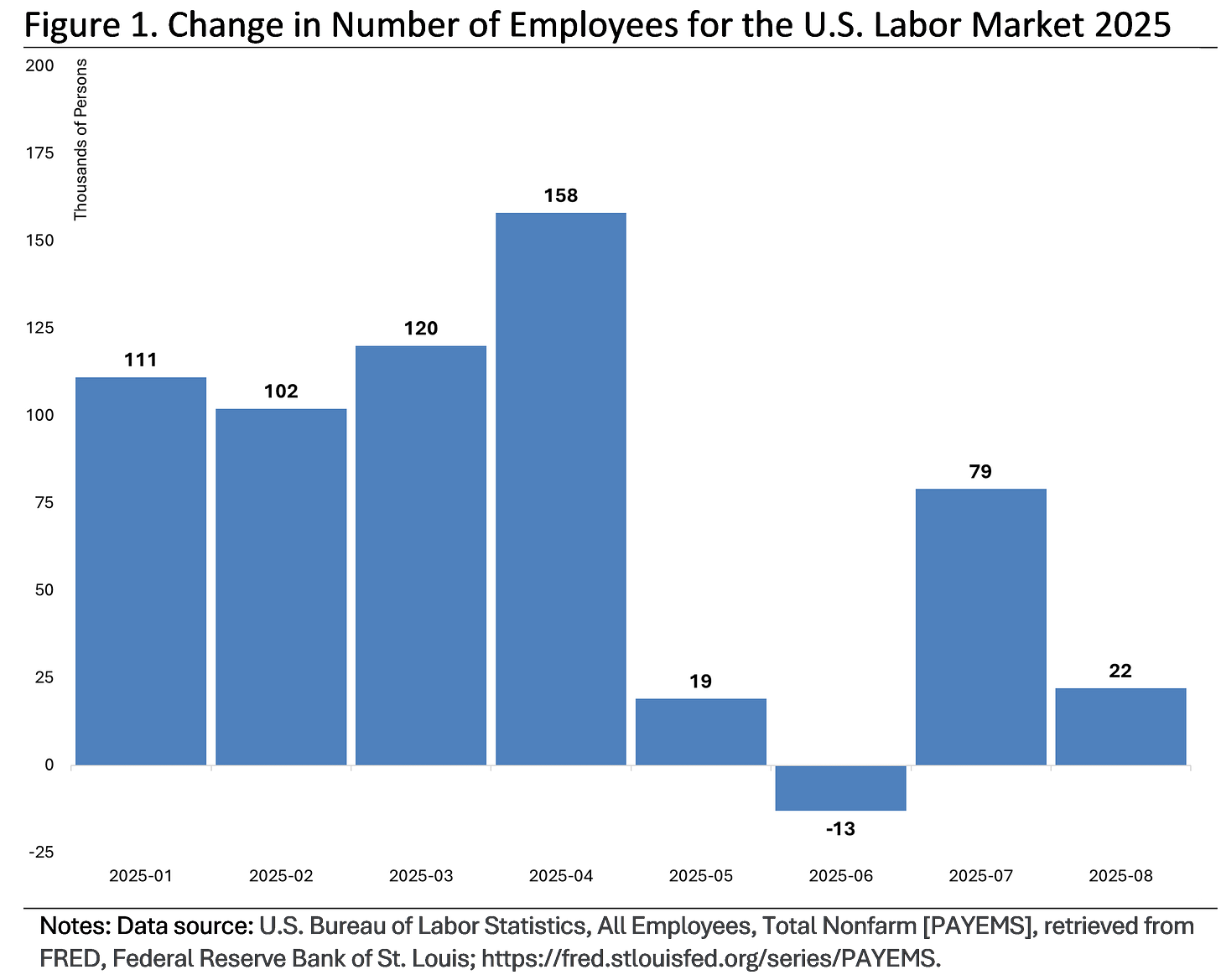

Figure 1 shows the change in total change in the number of employees per month in 2025.

The last four months is what has everyone worried, and the impetus for the boost to the chances will cut rates. Is this four-month slump normal from a historical perspective? Yes and no.

Figure 2 displays the same data as Figure 1, but back to 2016.

Visually this timeline is dominated by the Covid-19 era, of course (like most macroeconomic data). The take-away for us is that recent history does not look that different than the few years before 2020. The average monthly change from 2016 to 2019 was about 221 thousand persons, while the average since 2022 has been about 181 thousand.1

Yet, for 2025 the average has been about only 75 thousand, thanks to the last four months really bringing things down. The first four months averaged about 122, which is below the 2016 to 2019 average, of course; but 2024 wasn’t much better (with an average of about 167 thousand).

So, from this limited historical perspective, the job market is definitely a concern and strongly supports a rate cut (by the typical logic of when and why such a cut would happen).

The rock-and-the-hard-place

But, as alluded to in the title of this post, things aren’t so simple. When it comes to the Dual Mandate, the Fed is in a pickle.

The latest inflation report from the BLS shows that the CPI rate of inflation is not budging downwards. Said rate is still hovering around 3 percent, well above the 2 percent number the Fed considers “stable.”

In this case, this is a clear and real-time example of the inherent challenge of the Fed’s Dual Mandate. They have to achieve both job stability and price stability. If they cut rates to promote the former, they risk comprising the latter.

What to do? I suspect that next week the Fed will cut their target rate. The last four months of job market data are compelling enough that I am guessing the FOMC committee members will take the risk of leaning the side of job—even if that boosts the risk of compromising price stability.

Postscript

Want to understand more about the Fed and its Dual Mandate? Check out these various Macrosight articles on the subject:

To understand the Dual Mandate, check out “The Fed’s Conundrum,” and “Why does the Fed get to manipulate the Economy?”

To understand why the Fed has the independence to carry out the Dual Mandate, read about “The Werewolf Problem,” and “Street ‘Cred.”

To understand how the Fed uses their discretion in doing so, read “The Phantom Menace.” To get a sense of the pros and cons of the Fed using their discretion, read “The Great Moderation vs The Epic Fail,” and “The First Rule of Monetary Policy.”

If you want some background on the persons entrusted with this process, check out “Who is the Fed.”

And finally, to understand some of the ins and outs of monetary policy, read “Hacking the Fed’s Forecast of GDP;” “Why the interest rate, Fed?;” and “PCE, you complete me.”