Earlier this spring, the decline of real GDP in the first quarter and the confusion over the Trump administration’s tariff policy led to even more confusion about GDP itself.1

As ably explained by Noah Smith in multiple posts the past two years, numerous reputable news sources have betrayed a basic ignorance of how GDP is measured. In short, many news sources have been stating that the negative GDP growth in the first quarter was due to and increase in imports (a form of stock-piling in anticipation of higher tariffs). More generally, said news sources repeatedly claimed that imports reduce GDP. I encourage anyone interested in understanding this issue to read Noah Smith’s post.2

But, since Macrosight has written about GDP many times, here I provide a brief explanation and refresher on GDP from the Macro-101 perspective.

Why the confusion?

As Macrosight has explained in a previous post, GDP represents every thing bought, sold and produced in our economy. In measuring GDP, the Bureau of Economic Analysis also defines four major GDP-sub-categories within the broader statistic: consumer spending (68 percent of GDP), investment spending (about 17 percent of GDP), government spending (17 percent of GDP) and net exports (a negative 4.5 percent of GDP at the end of 2024).

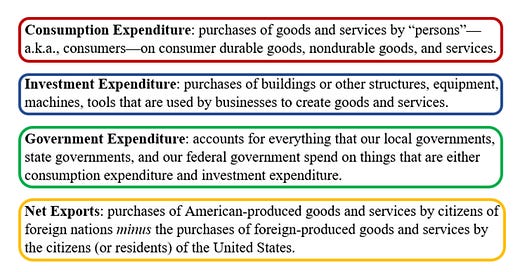

Those four categories define the “expenditure approach” to measuring GDP. And this is where the confusion stems. The four categories are summarized as follows:

Consumption Expenditure: purchases of goods and services by “persons”—a.k.a., consumers—on consumer durable goods, nondurable goods, and services.

Investment Expenditure: purchases of buildings or other structures, equipment, machines, tools that are used by businesses to create goods and services.

Government Expenditure: accounts for everything that our local governments, state governments, and our federal government spend on things that are either consumption expenditure and investment expenditure.

Net Exports: purchases of American-produced goods and services by citizens of foreign nations minus the purchases of foreign-produced goods and services by the citizens (or residents) of the United States.

These four categories are summarized in the ubiquitous (in Macro courses) GDP identity:

The confusion surrounding imports comes from the last one, NX.

NX, or Net Exports equals Exports minus Imports.

It is that minus that has been screwing everyone up—or that everyone has been screwing up when reporting on GDP and imports. One sees the minus and says, “aha, imports subtract from GDP; ergo a rise in imports causes a fall in GDP!”

But here’s the rub. The GDP identity—and how it is typically explained in textbooks or elsewhere—is, frankly, not clear enough. Why not? Let’s take consumption, for example.

The BEA’s handbook notes that the consumption category “records purchases for personal use by U.S. residents, wherever the purchases take place.”3

So, really, the consumption category as I describe it above should really read as,

Consumption Expenditure: purchases of goods and services by “persons”—a.k.a., consumers—on consumer durable goods, nondurable goods, and services; including such goods produced within the U.S. AND imported from abroad.

That is, consumer expenditure in the GDP statistic includes consumer goods and services the Hungry Beast purchased from foreign producers. From that perspective, the GDP identity should be written as:

In fact, the BEA’s handbook goes on to say that, “these expenditures [consumer purchases of imported goods and services] are also recorded as imports of goods and services; thus, the PCE [Consumption] and import entries cancel out in deriving GDP.”4

If that was more clearly stated in textbooks, the aforementioned confusion may be less of an issue.

I should add, too, that here I am just using consumption expenditure as the example. A similar scenario arises for the “I” as well (as explained with an example in Smith’s post).5

Again, the reason the BEA subtracts off Imports as part of Net Exports is to cancel out the number of imports included in consumer spending. They do so since GDP is Gross Domestic Product. It is a statistic that is intended to focus on domestic production.

What now?

The GDP-Import confusion does not imply that imports are not important to understanding our economy. It simply means it is not correct to say that an increase or decrease in imports causes a decline or increase of real GDP from one quarter to the next. It is not correct since an increase or decrease in imports will net out of the GDP statistic. Let me repeat, imports NET OUT of the statistic.

Alas, the confusion is likely only to continue. Early indications suggest that real GDP growth for the second quarter of this year could be quite robust. No doubt there will be headlines stating things like “Imports fall, GDP rises!” But, no, that will not be correct.

The BEA’s initial estimate at the end of April had GDP falling by -0.3 percent; the second estimate released at the end of May now has the value at -0.2 percent.

Noah Smith even notes that the BEA itself is getting it wrong! At least the person or persons writing the recent news releases for the BEA. In the least, they are providing misleading explanation of the issue. See Smiths’ recent post for that embarrassing-for-the-BEA critique.

See the NIPA Handbook, chapter five, bottom of page 5-3, at https://www.bea.gov/resources/methodologies/nipa-handbook/pdf/chapter-05.pdf.

See the NIPA Handbook, chapter five, bottom of page 5-3 and top of 5-4, at https://www.bea.gov/resources/methodologies/nipa-handbook/pdf/chapter-05.pdf.

Note, Macrosight has no affiliation with Noah Smith, nor his Substack, Noahpinion. In fact, a lot of Smith’s writing suggests he has a low opinion of macroeconomists. Nevertheless, Macrosight’s numerous citations and links to Noah’s work are out of admiration for Smith’s writing, and him “shouting it from the rooftops” with respect to this issue.