Macro Madness

It's a Cinderella Story

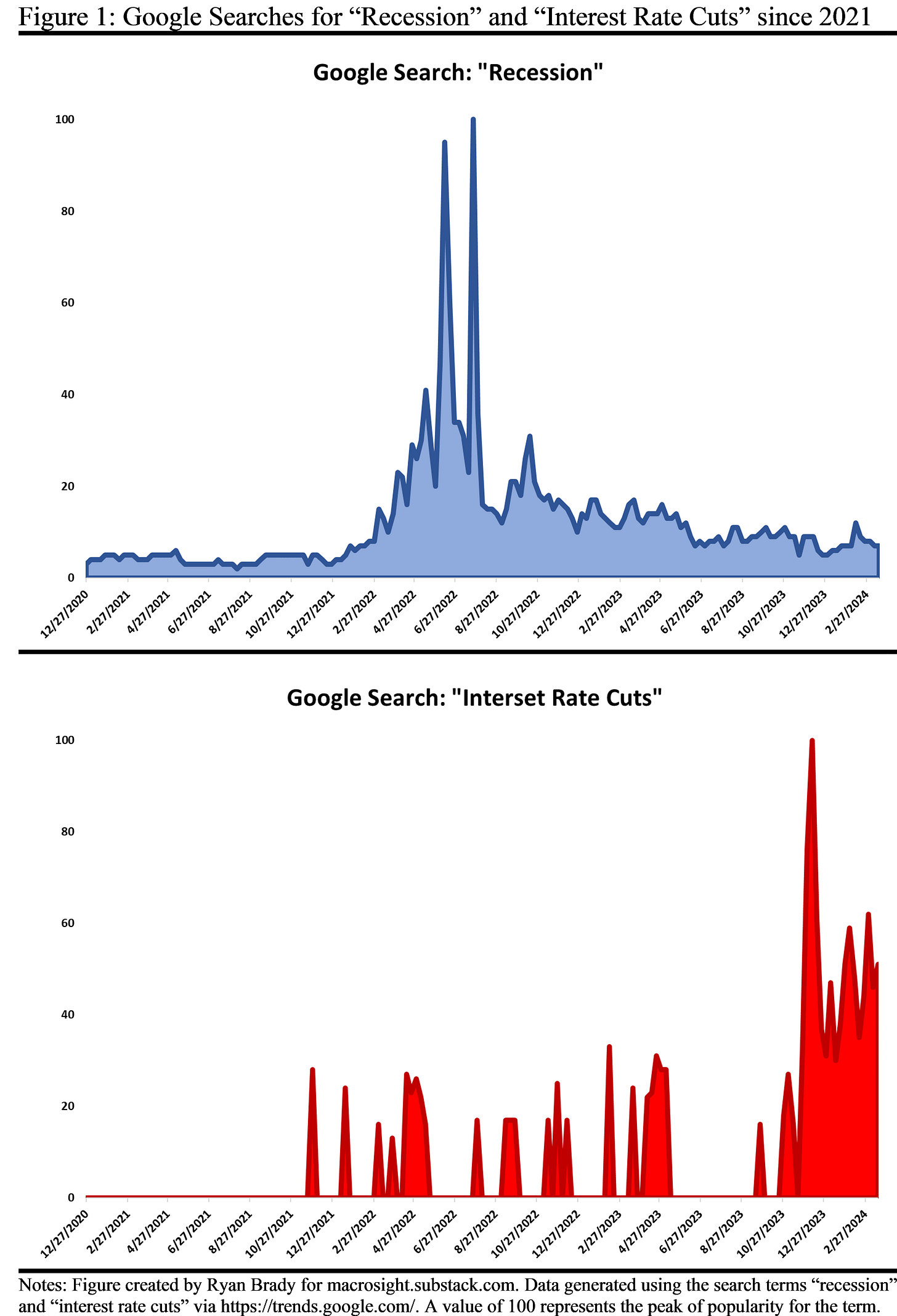

It wasn’t that long ago that a recession was the “talk of the town,” and all but a certainty according to some outlets. Yet, here in March of 2024, we find ourselves with a bit more optimism when it comes to the macroeconomy. According to Google Trends, and shown in Figure 1, there is more concern with interest rate cuts than a recession as of late. As shown in Figure 1, while searches for “recession” peaked in 2022, searches on “interest rate cuts” have surged the past few months.

The talk of recession back then was certainly warranted. Starting in March of 2022, the Fed raised its target interest rate 11 times, bringing the rate from zero to where it stands today, 5.3 percent. They did so in only 16 months.

Yet now, two-years later, we have not had a recession and the Fed, much to the delight of the stock market, is talking rate cuts! If you had suggested to any macroeconomist two years ago that the Fed would raise rates from zero to 5 percent in sixteen months and GDP growth would be above 2 percent by the end of it, they would have considered you mad.

GDP, a P-T-P?

This turn of events begs the question, if the interest rate increases the past two years did not fell the economy—real GDP growth has averaged 2.9 percent over that time—what is in store for us as rates decline?1 To address this question, it is time for some updated forecasts from Macrosight (previous forecasts can be found here and here).

Figure 2 displays the Macrosight forecast for quarterly GDP through the end of 2024. These quarterly forecasts were generated with a standard forecasting model with the inputs being the previous two quarters of real GDP growth (and the weights estimated on data spanning 1985Q1 through 2023Q4—Macrosight provided some explanation of this forecasting method here and here).

As shown on the figure, Macrosight forecasts real GDP growth to average 2.6 percent over 2024. While not as high as the average growth that occurred in 2023 (3.1 percent), this forecast is relatively optimistic in that this value is above the 2000 to 2020 average of 2 percent.

How does this forecast compare to the Fed’s? Figure 3 displays a snap-shot of the Fed’s forecast for real GDP, and their expectation for the Federal Funds rate, both released this week as part of their March meeting.

The Fed’s projection for 2024 real GDP growth is 2.1 percent. That is a bit below Macrosight’s forecast, but higher than what the Fed was thinking back in December of 2023.2

Notice also in Figure 3 the “projected appropriate policy path” for the federal funds rate, which is the Fed’s key variable for setting policy (for an explanation see here). The Fed expects to cut the federal funds rate by about 70 basis points from the current value of 5.3 percent.

Given the Fed’s plan, what should we expect for our economy? Let’s say the Fed cuts the federal funds rate by 70 basis meeting at their June meeting.3 Would real GDP growth get an immediate boost from such a cut? Would it get any boost?

And One!

Figure 4 displays the forecast for 2024 assuming the rate is cut by 70 basis points in June, and the effect on GDP is felt in the third and further quarters of 2024.4

With that modification, things look slightly brighter. While the effect of the drop in the interest rate does not have a substantial impact on the average for 2024, it does so on the quarterly growth rates for the second half of the year.

X’s and O’s

Given this predicted boost to GDP, what can we say about how likely this would be?

For the forecast displayed in Figure 4, I am assuming a very quick effect of the rate cut on GDP. This might occur if a rate cut inspires optimism and consumption and investment spending jump quickly early in the third quarter of 2024.

Similarly, if mortgage rates start to fall in late spring in anticipation of a lower federal funds rate (and/or in anticipation of inflation continuing to decline), then the effect, particularly for the housing market, could be felt sooner rather than later.

It is more likely, however—especially when it comes to interest-rate sectors like housing and autos—that the effect of a decline in interest rates would come in 2025. The typical conclusion of studies on the effect of monetary policy is that it takes months, if not more than a year, for a change in policy to translate to a change in spending.

As for the magnitude of any increase in GDP, will we see rates of 3.3 or 3.2 percent as shown in Figure 4? Those numbers are reasonable for what to expect, in my opinion. Given GDP growth averaged just above 3 percent in 2023, shouldn’t we expect at least a little boost to our economy above that from a decline in rates?

Air Ball

Admittedly, the above is very speculative (as is the nature of forecasting, of course). Which brings us to the proverbial elephant in the room.

As mentioned at the outset of this post, the Fed increased its interest rate target from zero to 5.3 percent in just under a year-and-a-half. Yet, as is evident in Figures 2 and 4, GDP growth remained steady over the second-half of 2022 and for the entirety of 2023. Over those six quarters, real GDP growth averaged 2.9 percent, which is almost a full percentage point higher than the average from 2000 to 2020. (If we look back further, 2.9 percent is also higher than the average of 2.6 percent from 1985 to 2020.)

So, here we are obsessing over interest rate cuts against the backdrop of recent history, where it seems that rate increases over the past two years had nary an effect on real GDP growth. In the least, those increases didn’t stop real GDP growth from chugging along at an average rate higher than the past few decades.

Where does this leave us now? Well, just like macroeconomists (current company included) didn’t see Beastflation coming, or anticipate GDP growth surging to over 5 percent in 2021, or predict 3.1 percent for GDP in 2023 amidst rising interest rates, or expect a persistently low unemployment rate, we can probably add “the effect of future rate cuts on GDP” to the list.

In other words, Macrosight doesn’t know what is going to happen, nor does any other macroeconomist, the Fed, pundit, TV-talking head, or self-proclaimed prophet.

Our economy keeps defying expectations, surprising us for the better and busting every forecaster’s bracket along the way. With every twist and turn of the business cycle, we keep getting it wrong. That, alas, is our Macro Madness.

“P-T-P” is an homage to legendary sports figure, Dick Vitale. It stands for “prime-time-player.”

If the weights in Macrosight’s model are estimated from data spanning 2000Q1 through 2023Q4, the 2024 forecast comes out to equal 2.0 percent—very close to the Fed’s forecast.

In practice, it is unlikely they will cut the rate by that much all at once. Rather they would likely lower it by about 25 basis points per meeting until they reach 4.6 percent.

To arrive at this forecast, I included the federal funds rate as an additional input in my model. I also assumed a relatively strong effect of the interest rate on real GDP, equal to –1.0. An effect of –1.0 means that as the interest rate decreases by 1.0 percent (or 100 basis points), real GDP growth increases by 1.0 percent. For more discussion on this strategy, see this previous Macrosight post.